Press Releases & Statements

Nippon Steel Deal — Allegheny Conference CEO Stefani Pashman

May 23, 2025Press Releases & Statements

Pittsburgh Region Celebrates Hitachi Energy’s Expansion Plans

April 11, 2025Press Releases & Statements

Pittsburgh Region Sparks Key Energy Opportunity with New Power Generation Facility

April 9, 2025Press Releases & Statements

Pittsburgh Region Welcomes Country’s Largest Natural Gas-Powered Data Center Campus

April 3, 2025News

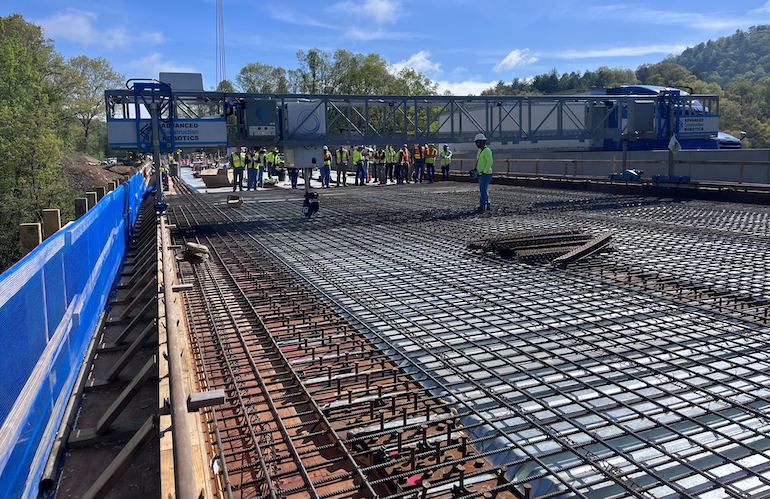

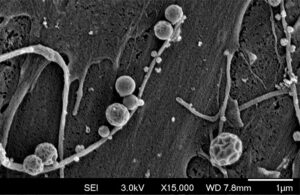

Robots greet students, sales force at third annual Robotics Discovery Day in Pittsburgh

November 20, 2024News

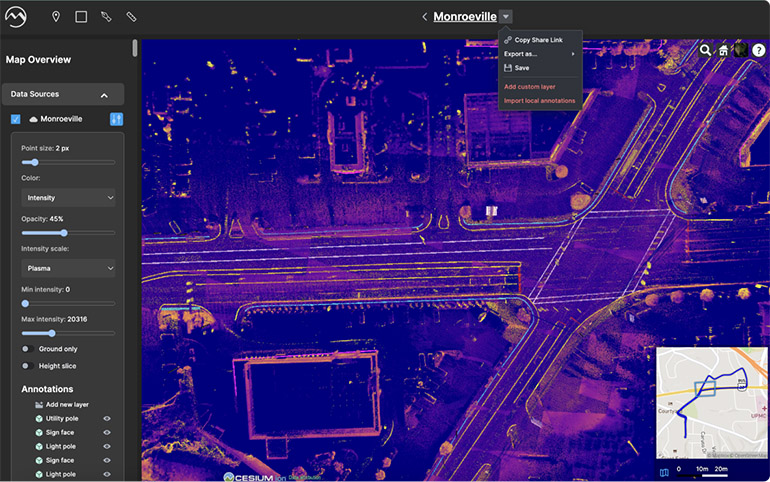

Mach9 Robotics accelerates geospatial data processing for infrastructure industry

September 16, 2024Press Releases & Statements

Nextracker and JENNMAR Subsidiary JM Steel Bolster U.S. Supply Chain with New Facility Expansion to Triple Capacity for Solar Energy Projects

April 26, 2024Press Releases & Statements

The Pittsburgh Region Will Be on the Global Stage with Its Premiere at CES 2024

January 4, 2024Video

The Great Allegheny Passage - A 150-Mile Trail Connecting Pittsburgh to Maryland

November 30, 2023Video

Bringing Pittsburgh to the World: Pittsburgh Regional Alliance Travel Recap 2023

September 22, 2023News

SoftBank backs new autonomous trucking startup from founders of defunct Argo AI

September 7, 2023News